Our Fashion Financial Model Structure covers all the essential aspects you need to consider when starting or scaling a Fashion business. By following this structure, you can better understand your revenue streams, costs, and assets, helping you optimize profitability and strategically plan for growth.

Financial planning is a critical aspect of running a successful fashion business; whether you’re in the start-up phase or seeking to expand. A well-structured fashion financial model outlines typical revenues, direct costs, employees, expenses, and assets you need to consider. This comprehensive model can also provide insights into new and profitable revenue streams you might not have previously considered. Although the numbers can seem daunting, it is essential to grasp them because they can shape the future of your venture.

The Fashion financial model structure

Revenues

The typical revenue streams in a fashion business encompass various avenues. Retail sales are calculated by multiplying the number of units sold by the price per unit. Wholesale generates revenue through bulk transactions with other businesses, calculated using a method akin to retail sales, with adjustments for wholesale pricing. E-commerce contributes revenue from selling products online; here, total online sales volume combines with the average online price. Brand collaborations yield earnings derived from partnerships with other brands, usually calculated as a fixed fee or percentage of sales. Subscription services provide regular revenue from subscription-based models, typically determined by the monthly fee multiplied by the number of subscribers. Licensing allows income generation through permitting other companies to utilize your designs, typically a fixed percentage of the licensee’s sales. Pop-up shops create temporary retail spaces that add alternative sales streams, calculated by total sales during the event. Although these streams hold potential, the success of a fashion business hinges on the effective management of each revenue source.

Cost of goods sold

The cost of goods sold (COGS) for a fashion business typically encompasses fabric and materials, which represent the expense associated with raw materials utilized in production; manufacturing, encompassing labor and overhead essential for producing your goods. Freight and shipping involve costs related to transporting goods, while packaging pertains to expenses linked to the packaging of finished products. Furthermore, inventory shrinkage reflects losses arising from theft, damage, or obsolescence. These elements collectively contribute to the overall financial dynamics of the business, which can impact profitability significantly. Managing these costs is challenging but essential for sustainable operations. This intricate web of expenses requires careful oversight because each component plays a critical role in maintaining efficiency and competitiveness.

Employees

Typical roles in a fashion business might include: fashion designer , responsible for creating and conceptualizing new clothing designs; product manager , oversees production processes and ensures the product meets the company standards; marketing specialist , develops strategies to promote and sell fashion products; retail manager , handles operations of retail stores and customer relations; accountant , manages financial records and reporting; logistics coordinator , manages supply chain operations and inventory tracking. This list is not exhaustive because many other positions exist that contribute to the success of a fashion company. Although the roles may vary, they all share a common goal: to create and deliver appealing products to consumers. But, in the fast-paced industry, adaptability is crucial for success.

Operating expenses

Common operating expenses include:

- Rent : Lease and real estate costs for retail or office space can be substantial; however, one must consider the overall impact on the budget. Utilities such as electricity, water, and other utility expenses represent another significant financial commitment. Marketing and advertising—often overlooked—are also crucial: costs associated with promotional activities can greatly affect visibility. Although these expenses may seem daunting, they are necessary for success in a competitive market. This is because effective marketing can drive traffic, while managing utilities is essential for operational efficiency.

- Salaries and Wages : Employee compensation.

- Insurance : Business, property, and liability insurance premiums can vary significantly; however, they are essential for protecting assets.

- Professional Fees : Payments for legal, consulting, or accounting services.

- Travel Expenses : Costs for business travel often accumulate quickly, especially when trips are frequent.

- IT and Software : Costs for technology and software tools are increasingly important in a digital age.

- Maintenance and Repairs : Expenses for maintaining facilities and equipment; they are necessary to ensure operational efficiency.

- Office Supplies : Costs for general office and operational materials; they support daily activities. Although these expenses seem mundane, careful management of resources is vital for success.

Assets

Common assets for a fashion business can encompass a variety of elements: inventory, which includes stock of raw materials and finished products, sewing machines as essential equipment for production, properties, which are real estate used for production or retail purposes, design software as crucial tools for crafting fashion designs, and vehicles used for transporting materials and products. The significance of each component varies, especially because some businesses may prioritize technology over physical assets. While all these elements are important, there are instances where certain businesses thrive with minimal resources. Recognizing that the effective management of these assets often determines overall success is crucial.

Funding options

Typical funding options include:

- Bank Loans : Financing through financial institutions can be beneficial; however, they often come with strict repayment terms.

- Angel Investors : Private individuals who provide capital for start-ups but typically expect a return on their investment.

- Venture Capital : Investment from firms specializing in high-potential businesses, although these firms usually take an active role in management.

- Crowdfunding : Raising small amounts of money from a large number of people, usually via online platforms, can democratize funding opportunities.

- Grants : Non-repayable funds from government or private organizations aim to support specific initiatives without the burden of debt.

Driver-based financial model for Fashion

A truly professional fashion financial model hinges on the operating KPIs (commonly referred to as “drivers”) pertinent to the fashion industry. These drivers elucidate essential activities that exert the most significant influence on business outcomes. Average Order Value, the average dollar amount spent whenever a customer places an order, plays a crucial role. Customer Acquisition Cost denotes the expenditure tied to acquiring a new customer, while Conversion Rate indicates the percentage of website visitors who ultimately make a purchase. Inventory Turnover Rate measures how many times inventory is sold and subsequently replaced over a specific period. Seasonality Impact reflects the repercussions of seasonal fluctuations on sales and demand, while Return Rate signifies the percentage of sold products that customers return. Gross Margin Percentage illustrates the proportion of total sales revenue that remains after accounting for direct costs incurred in producing goods. This leads to Market Growth Rate, which defines how quickly the fashion market is anticipated to expand, while Repeat Customer Rate indicates the percentage of customers who return to make additional purchases.

Driver-based financial planning serves as a method for identifying key activities, often referred to as ‘drivers,’ that exert the greatest influence on business outcomes. Subsequently, you can construct your financial plans predicated on these activities. This approach facilitates the establishment of connections between financial results and essential resources (such as personnel, marketing budgets, and equipment). If you’re interested in delving deeper into driver-based financial planning—especially regarding its efficacy—consider viewing the founder of Modeliks elucidating this concept in the video below.

Need a business plan?

Create one with Modeliks AI in the next hour!

AI powered business planning for Startups and SMEs.

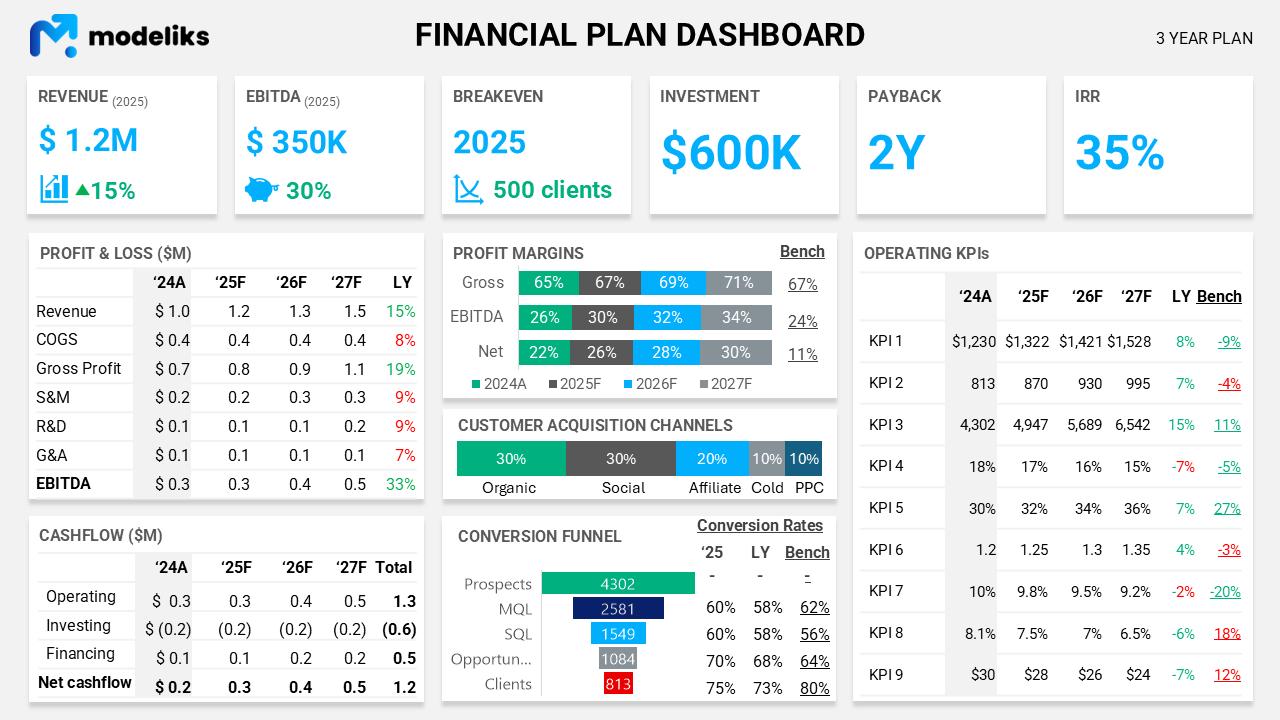

The financial plan output

The objective of financial forecast outputs should enable you, your management team, board, or investors to: quickly comprehend how your fashion business will function in the future, gain reassurance that the plan is well thought out, pragmatic, and attainable. Furthermore, to grasp what investments are necessary to execute this plan and what the returns on those investments will be. To accomplish these aims, there exists a one-page template for effectively presenting your financial plan.

Aside from this summary of your plan, you will require three projected financial statements; however, you might find that the details can become overwhelming. Although this may seem daunting, it’s essential to establish a clear path forward.

- Profit and Loss

- Balance Sheet

- Cash Flow Statement

Fashion financial model summary

A professional fashion financial model will assist you in contemplating your business and pinpointing the resources needed to reach your targets. It can also help you set goals, measure performance, raise funding, and make confident decisions to manage and grow your business. By thoroughly understanding each component, as well as the key drivers, fashion entrepreneurs can effectively strategize and position their business for success in a competitive marketplace. Although this process may seem complex, it is essential because it allows for informed decision-making and strategic planning.

If you need help with your financial plan, try Modeliks , a financial planning solution for SMEs and startups or contact us at contact@modeliks.com and we can help.

Author:

Blagoja Hamamdjiev

, Founder and CEO of

Modeliks

, Entrepreneur, and business planning expert.

In the last 20 years, he helped everything from startups to multi-billion-dollar conglomerates plan, manage, fundraise, and grow.

TAKE MODELIKS FOR A SPIN

Not sure which plan?

Start with a 15 days free trial.

You will have access to the full functionality of Modeliks. The only restriction in the free trial is that you cannot download or share your business plan outside Modeliks. Credit card is not required to subscribe for the free trial.